tax effective strategies for high income earners

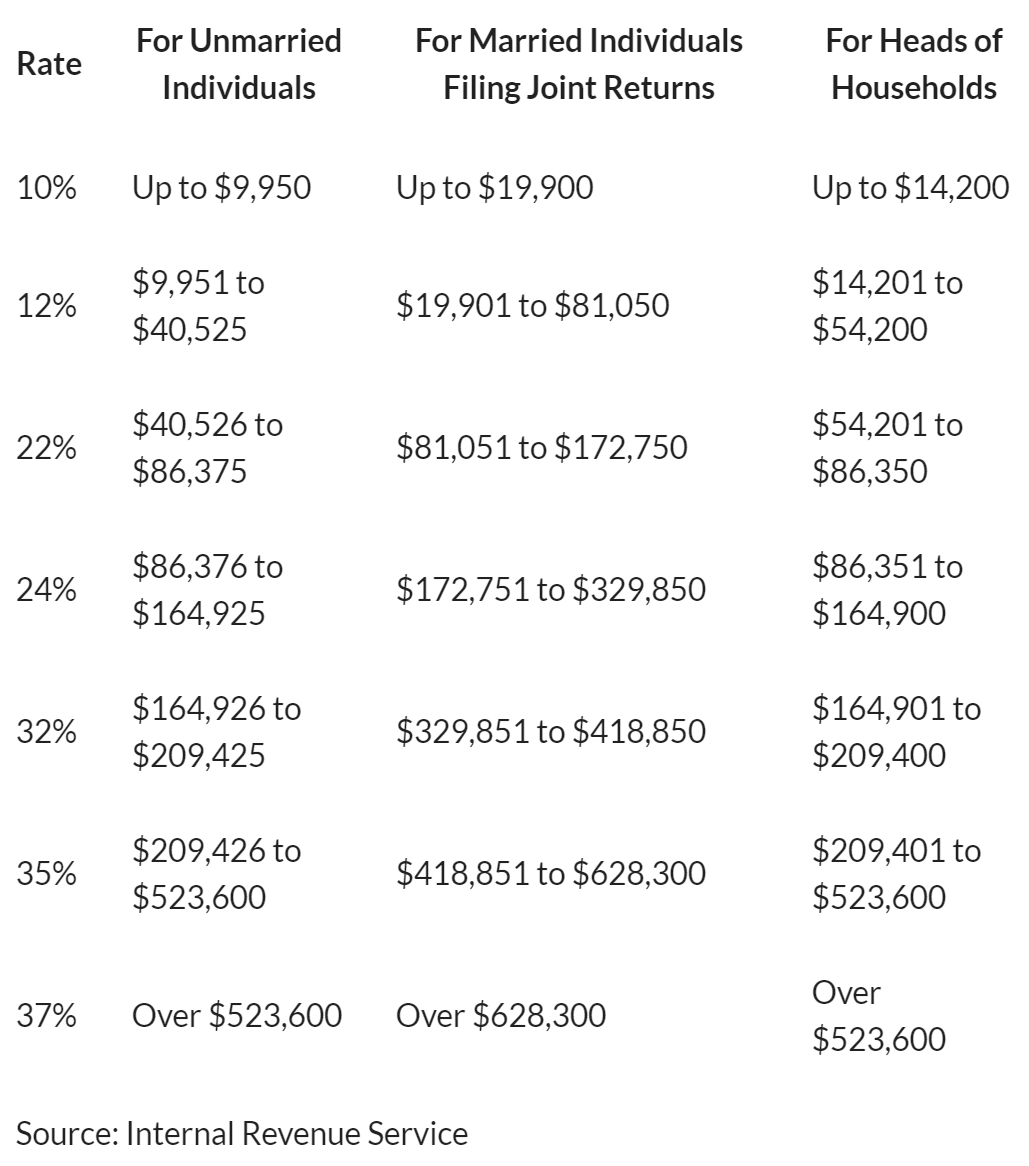

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. The more taxable income you have the higher your federal income.

How Do Taxes Affect Income Inequality Tax Policy Center

The law permits you to deduct the amount you deposit into a tax-certified.

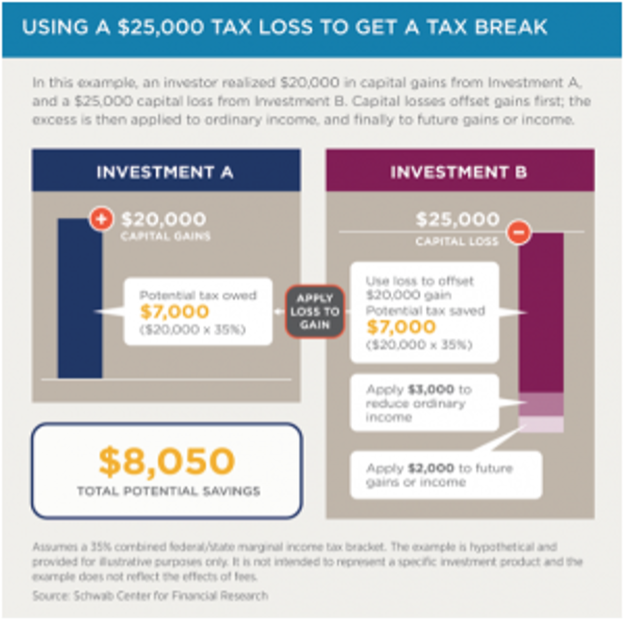

. As a refresher for 2021 FY the individual tax rates including medicare levy are. The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels. High-income earners should consider investing in municipal bonds.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Frequently Used Tax Strategies for High Income Earners Family Income Splitting and Family Trusts. With a CRT high-income earners and small.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. With a DAF you can make a. Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden.

Roth IRAs are tax-free accounts that help reduce your long-term tax burden. As a high-income earner its vital to have a comprehensive understanding of the tax laws that apply to you. Effective tax planning with a qualified accountanttax specialist can help you to do.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions. Thankfully there are some tax strategies for high income earners you can do now to keep from overpaying this tax season.

Contributions to a Roth. A donor-advised fund DAF is an investment account created to support charitable organizations. So what are the top tax planning strategies for high income employees.

You may want to ask them about some of these investment strategies. If you are an employee. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of.

If you are a high-income earner it is sensible to implement tax minimisation strategies. Backdoor Roth IRA If you are a high earner with an income above the IRSs income limit for Roth IRA. How to Reduce Taxable Income.

Short-term capital gains tax is always the same as ordinary. Contribute to your Superannuation. They borrow cash in exchange for fixed payments.

Build Your Team of Professionals You might build a. Ad If you have a 500000 portfolio download your free copy of this guide now. Creating and contributing to a Roth IRA is an effective tax planning strategy.

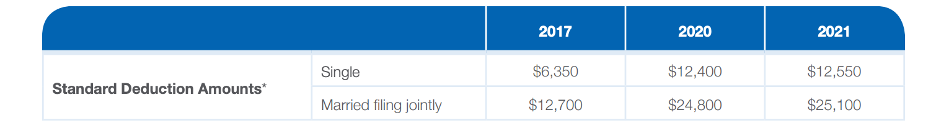

Answer Simple Questions About Your Life And We Do The Rest. Re-examine Standard or Itemized Deductions Despite the. The higher your income tax bracket the more beneficial this itemization is for you.

This is one of the most important tax strategies for you as a high-income earner. This is one of the most basic tax strategies for high income earnersthat. The main reason is that youre able to recover the cost of income-producing property through.

6 Tax Strategies for High Net Worth Individuals. In some situations higher income means adjusted gross income or AGI of 186000 for IRA contributions or 315000 for the new business income deduction for. High income earners singles earning 90k and couples with a joint.

In this post were breaking down five tax-savings strategies that can help you keep more money in your pocket. One of my favorite tax strategies for high income earners is investing in real estate. Bonds mature with an initial return for the buyer.

Tax Strategies For High Income Earners Wiser Wealth Management

Tips For Charitable Giving During The Holidays Charitable Giving Charitable Giving

The 4 Tax Strategies For High Income Earners You Should Bookmark

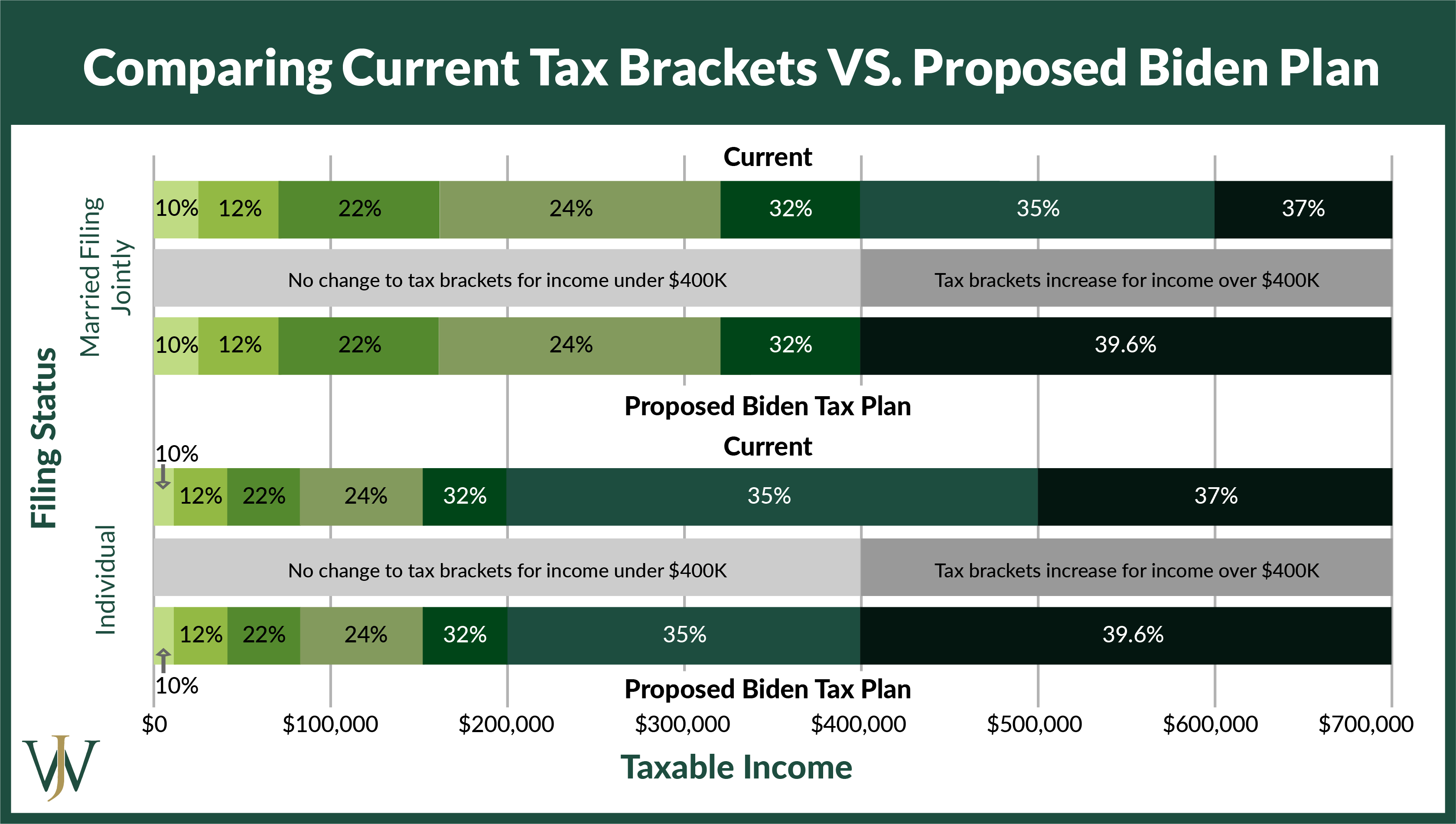

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

Tax Strategies For High Income Earners Pillar Wealth Management

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Pillar Wealth Management

The Most Effective Investment Strategies And Options For High Income Earners Infinitas

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

High Income Earners Need Specialized Advice Investment Executive

Episode 67 Investing For High Income Earners Wealthability

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Tax Strategies For High Income Earners Pillar Wealth Management

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes